This is a really high amount,and we are facing a lose-lose situation in terms of dealing with our debt

This is a really high amount,and we are facing a lose-lose situation in terms of dealing with our debt

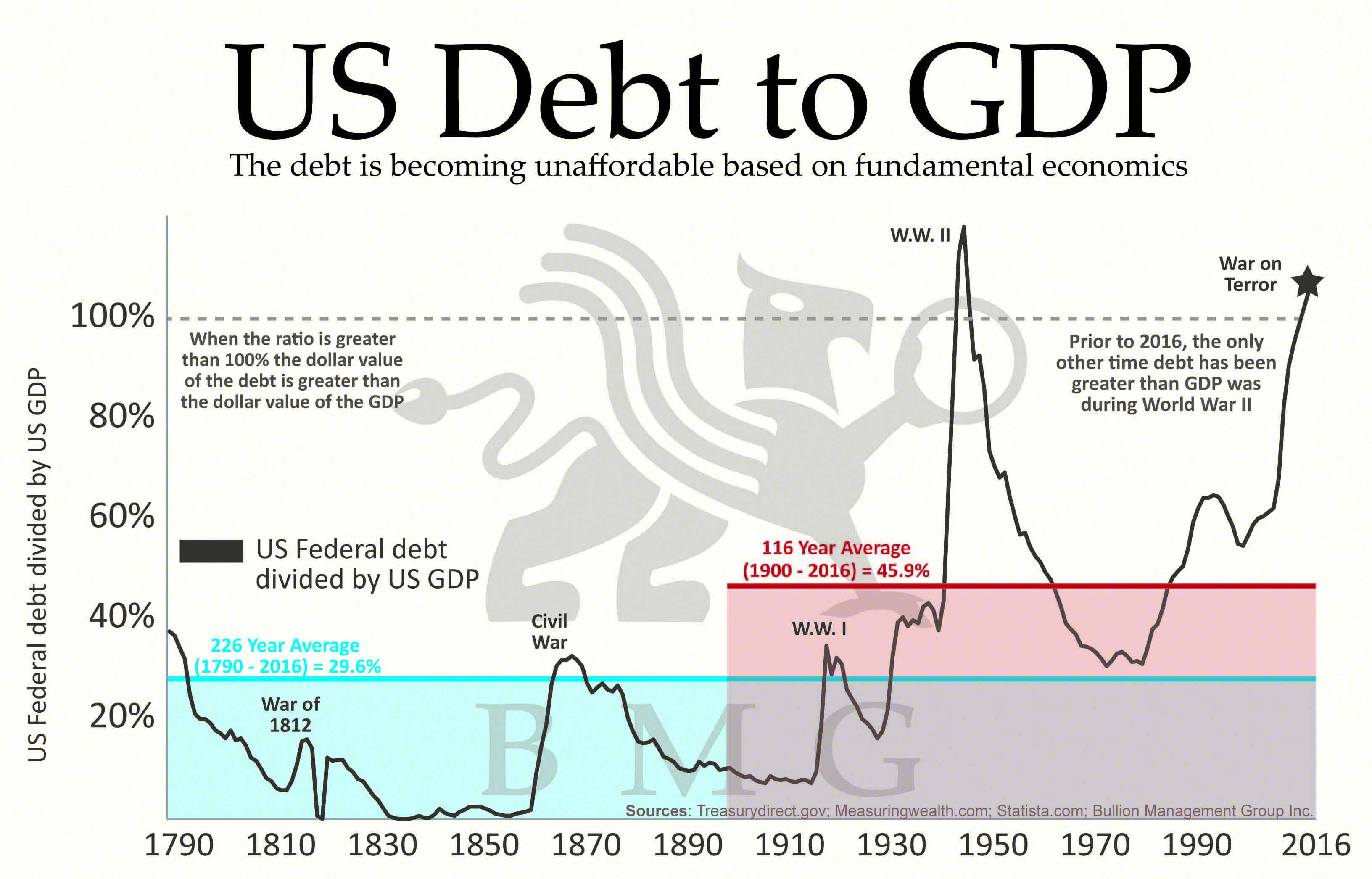

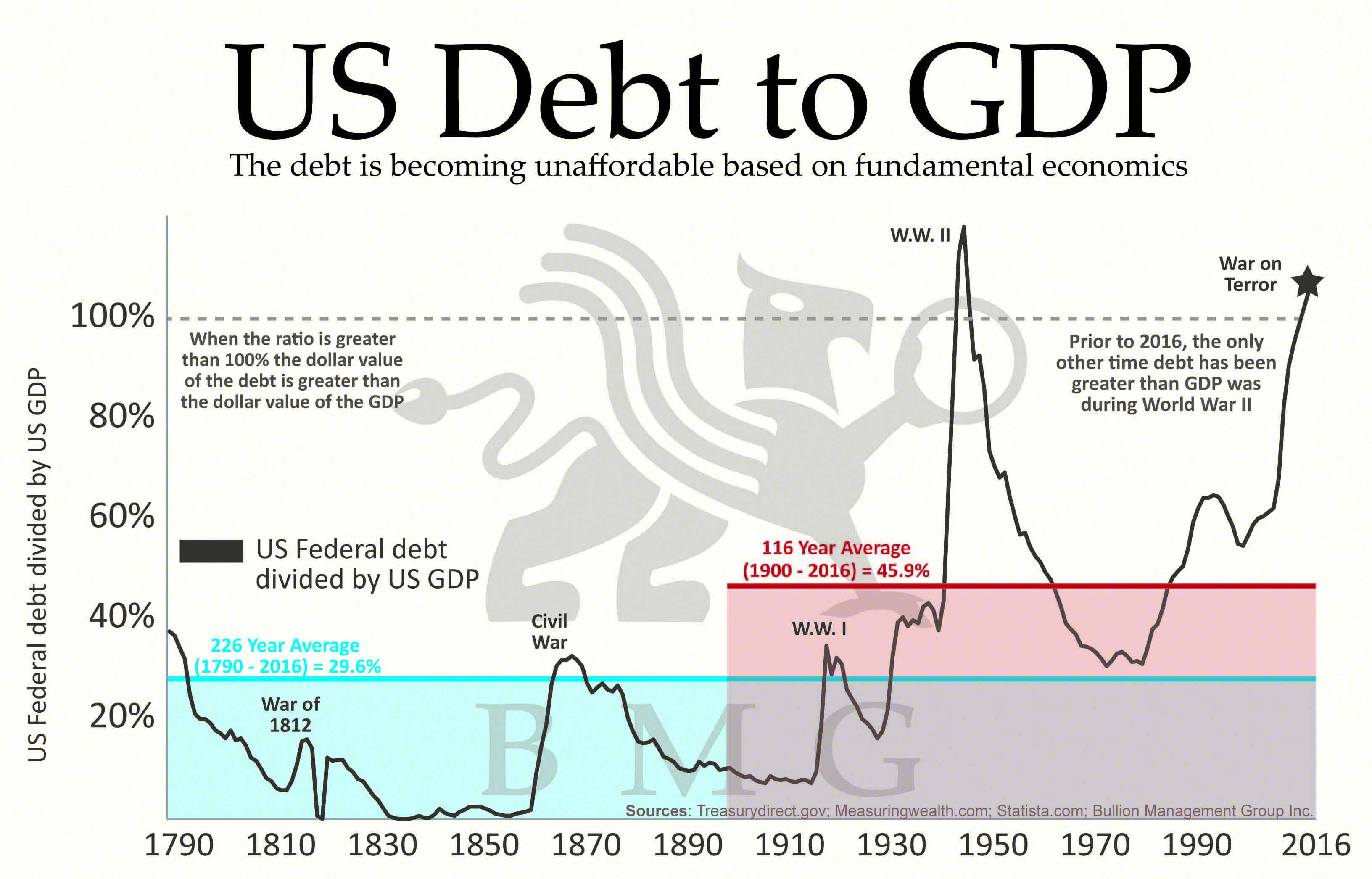

Currently in the United States we have a debt/GDP ratio of 1.20, which our national debt is 120% of our GDP, according to the office of Management and Budget. To give you an idea of how high this ratio is currently, lets look at some historical figures.

In the 1970s debt/GDP was between 30%-40%, and in the year 2000 we were 60% debt/GDP. Since the year 2010 debt levels have risen dramatically, primarily because back then the government was trying to deal with the affects of the great recession. Since then interest rates have been going down, and when the COVID-19 pandemic hit governments rushed to issue stimulus payments to help keep the economy afloat.

With our debt levels high and interest rates going higher we are in a dilemma. The United States government runs the risk of large interest payments because of higher interest rates. Well, I am sure someone is saying, well let’s keep interest rates low… then we have to deal with a weakening dollar and higher inflation. I’m sure you have noticed on social media that everyone is complaining of the sky-high prices. Well, if we keep rates low that will only get worse.

If we raise rates, then the government could have some defaults. That would be catastrophic, and the full faith of the U.S. dollar would be on the risk. Remember the currency in the United States is not backed by anything, we are on the fiat money system. Nations that are on the gold standard often do not have to worry about a worthless currency, but we in the United States do, because again our currency is not backed by anything other than the government saying a piece of paper with the picture of a former president has value.

This is not an issue that we can face overnight. Government(s) need to plan to tackle this situation over the next 10-15 years to reduce the debt by 30%.